Bookkeeping involves keeping track of your finances on a spreadsheet. At minimum, you need to track amounts, dates, vendors, and clients. The first, and easiest, thing to do for your business’ financial well-being is separate your finances.

How do I qualify for an SBA loan?

Business loans can be an asset to business, but it’s not something you should take lightly. Then, we’ll look at how to manage small business administration once you’ve got money in the bank. Learn why cash flow is vital to your business, how to create a cash flow forecast, and how terms like burn rate and cash runway impact your business. If any of those dates fall on a weekend or holiday, the deadline shifts to the next business day. If you don’t save for taxes, you won’t be able to pay these big bills when they’re due.

- It eliminates the hassle of setting up a third-party payment provider or merchant account and having to enter the credentials into Shopify.

- This guide collects resources covering small business financial topics critical to growth.

- However, you have to keep proper documentation to support those deductions.

- Ensuring the financial health of your business requires managing your cash flow efficiently.

- Business owners often turn to friends and family for funding when starting a new venture.

Plan for and pay business taxes

When you open a bank account for your business, consider opening both a business checking and a business savings account. Funding is one of the most important financial choices you’ll make in your business. Managing your business finances is critical to keeping your small business running smoothly and making informed decisions.

A CPA can look at your business plan and budget, help shed light on anything you might have missed, and get you amended 1040x using sprintax set up with a bookkeeping process tailored to your industry. If you need help writing your plan, use our free business plan template to guide you. There are two accounting methods small businesses can use—cash and accrual.

Discover the world’s #1 plan building software

At some point in your business, you’ll likely need to buy, upgrade, or replace different pieces of equipment. You can avoid the lengthy application processes with minimal paperwork and no credit check. Within funding through Shopify Capital, you can get the financial support you need quickly and easily. I just didn’t want glossary of business terms to deal with the whole process of going through a bank—I wanted to focus on the business. Through Shopify Capital, you get the money you need to grow your business with just a few clicks.

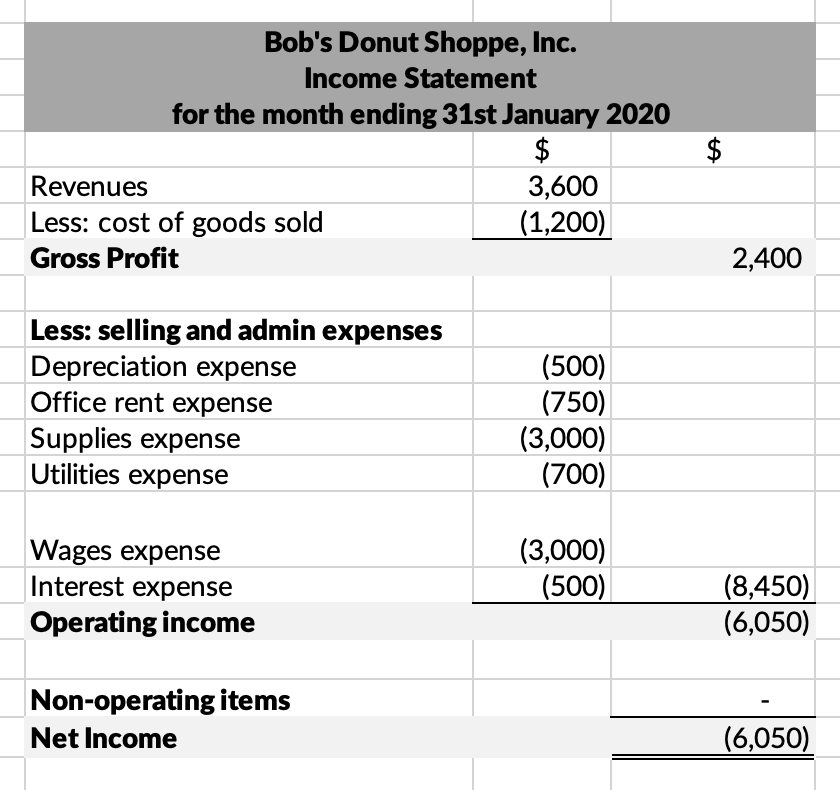

If your net profit is low, you might need either to decrease your operating expenses or increase the cost of your product. If your business started as a side hustle, you may already have some preliminary sales data. Even a few numbers can help you figure out which of your products are bestsellers and what times of year your sales will be high or low.

Make sure to talk to the CPA one-on-one to get a sense of whether or not they’re the right CPA for you. If your business is still more of a side hustle, or if its finances are simple, you likely can skip enlisting the help of a CPA for now. There are plenty of small-business finance resources online you can reference. Shopify Capital offers small business funding in the form of merchant cash advances to eligible merchants in the United Kingdom. Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current. Our information is based on independent research and may differ from what you see from a financial institution or service provider.

If you’re lost when it comes to proper accounting and business funds or resource management, you might find yourself unable to invest in or grow your business. With the double-entry system, every transaction is entered into your books twice. It’s more complicated than single entry, but it provides more information about your business. Unlike single entry, double-entry bookkeeping tracks your assets and liabilities in addition to revenue and expenses and has the checks and balances needed to reduce errors. Double-entry bookkeeping also gives you the information needed to create detailed financial statements showing which areas of your business revenue is flowing into and out of. If your business is small and you’re not making a lot of transactions, single-entry is the simplest way cash reconciliation to keep your books.